are union dues tax deductible in california

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. FREE for simple returns with discounts available for TaxFormFinder users.

Deduction Police Fill Online Printable Fillable Blank Pdffiller

Forms 1120 and 1120-S - Retained Earnings.

. High school collegeuniversity masters or pHD and we will assign you a writer who can satisfactorily meet your professors expectations. With the Union Plus legal services discount I saved roughly 1200 on a lawyer when I adopted my daughter last year. The Volunteer Income Tax Assistance VITA program offers free tax help to people who generally make 58000 or less persons with disabilities and limited-English-speaking taxpayers who need help preparing their own tax returns.

If you need more space to answer any questions on this form attach an 8 12-by. If you didnt claim a medical or dental expense that would have been deductible in an earlier year you can file Form 1040-X Amended US. IRS Publication 600.

File Now with TurboTax. It is primarily based on each parents tax filing status single married or head of household and average monthly income. This estimate is based on explain.

Lasry pressed to make union dues deductible restore home office deductions for employees and allow contract workers to itemize deductions on gas mileage work clothes lodging and dining. Also even though unreimbursed. File your California and Federal tax returns online with TurboTax in minutes.

Generally receipts are considered total income or in the case of a sole proprietorship independent contractor or self-employed individual gross income plus cost of goods sold and excludes net capital gains or losses as these terms are defined and reported on IRS tax return forms. Once you have taken out pre-tax deductions the remaining pay is taxed. I claim the following number of exemptions including myself on my taxes specify.

The FICA tax rate is 765145 for Medicare and 62 for Social Security taxes. I file state tax returns in California other specify state. I estimate the gross monthly income before taxes of the other party in this case at specify.

EFiling is easier faster and safer than filling out paper tax forms. The alternative minimum tax AMT is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals estates and trustsAs of tax year 2018 the AMT raises about 52 billion or 04 of all federal income tax revenue affecting 01 of taxpayers mostly in the upper income ranges. Generally a claim for refund must be filed within 3 years from the date the original.

Dont claim the expense on this years return. We always make sure that writers follow all your instructions precisely. A deduction is also given for any child andor spousal support that a parent pays for a child.

The Tax Reform Act of 1986 was the top domestic priority of President Reagans second term. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. Itemize the nature and amount of the expenses claimed in Section I.

Individual Income Tax Return to claim a refund for the year in which you overlooked the expense. Taxes collected for and. I estimate the gross monthly income before taxes of the other party in this case at specify.

Allowances are made for mandatory deductions such as federal and state taxes and health insurance premiums and union dues paid. A document published by the Internal Revenue Service IRS that provides information on deducting state and local sales taxes from federal income tax. LINE 1 Enter the amount of union dues assessments and initiation fees paid if the amounts are.

The act lowered federal income tax rates decreasing the number of tax brackets and reducing the top tax rate from 50 percent to. Thats three years worth of my tax-deductible union dues. EFile your California tax return now.

Form 1125-E - Deductible Compensation. You can choose your academic level. Other tax rates will be determined by.

IRS Publication 600 was. I file state tax returns in California. Thats three years worth of my tax-deductible union dues.

Record Retention - How Long to Save Your Return. Get all the tax help you need by browsing through various topics provided by TaxAct and file your taxes successfully. The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older.

Can I Deduct Union Dues Now. Paid as a condition of continued membership in the union and membership is related directly to the job for which the expense is claimed. Or A required payment of a wage deduction under an agency shop.

The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986. Form 2553 - S Corporation Election for States. Form 8453 - Attaching Signed Form to a Federal Business Return.

This estimate is based on explain. If you need more space to answer any questions on this form attach an 8 12-by. I claim the following number of exemptions including myself on my taxes specify.

Gross receipts do not include the following. Tax reform changed the rules of union due deductions.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Different Types Of Payroll Deductions Gusto

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

When Itemizing Can You Deduct State Capital Gains Taxes From Federal Taxable Income Quora

What Are Payroll Deductions Article

What Are Payroll Deductions Article

Deduction Police Fill Online Printable Fillable Blank Pdffiller

Top 25 Small Business Tax Deductions Small Business Trends

Explore Our Sample Of Auto Repair Bill Template For Free Invoice Template Word Invoice Template Receipt Template

Commonly Overlooked Tax Deductions Real Simple

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Charitable Deductions On Your Tax Return Cash And Gifts

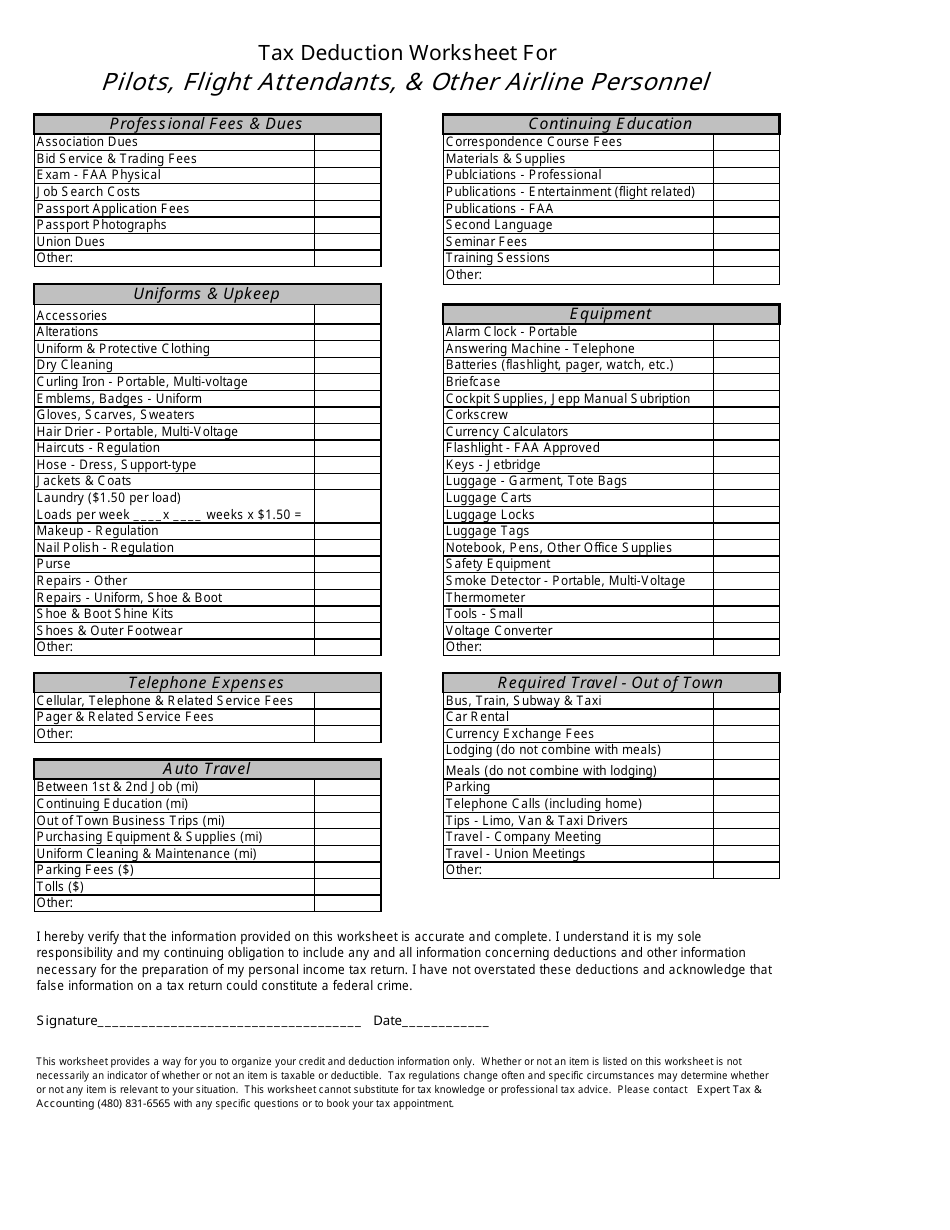

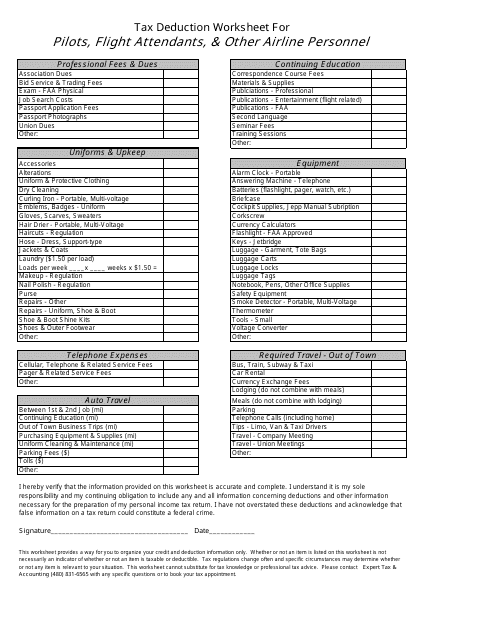

Tax Deduction Worksheet For Pilots Flight Attendants Other Airline Personnel Download Printable Pdf Templateroller

Solved Identify The Following Items As Deductible For Agi Chegg Com

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Is It Deductible Taxaudit Blog

Tax Deduction Worksheet For Pilots Flight Attendants Other Airline Personnel Download Printable Pdf Templateroller